Table of Contents

ToggleLooking to relocate or just curious about the cost of living? The debate between Colorado and California rages on, but which state is truly more affordable? It’s not just about sunshine and snow: it’s about your wallet too. So, grab your favorite beverage, sit back, and let’s unravel the financial intricacies of these two beautiful states. Spoiler alert: your bank account might have some strong feelings about your choice.

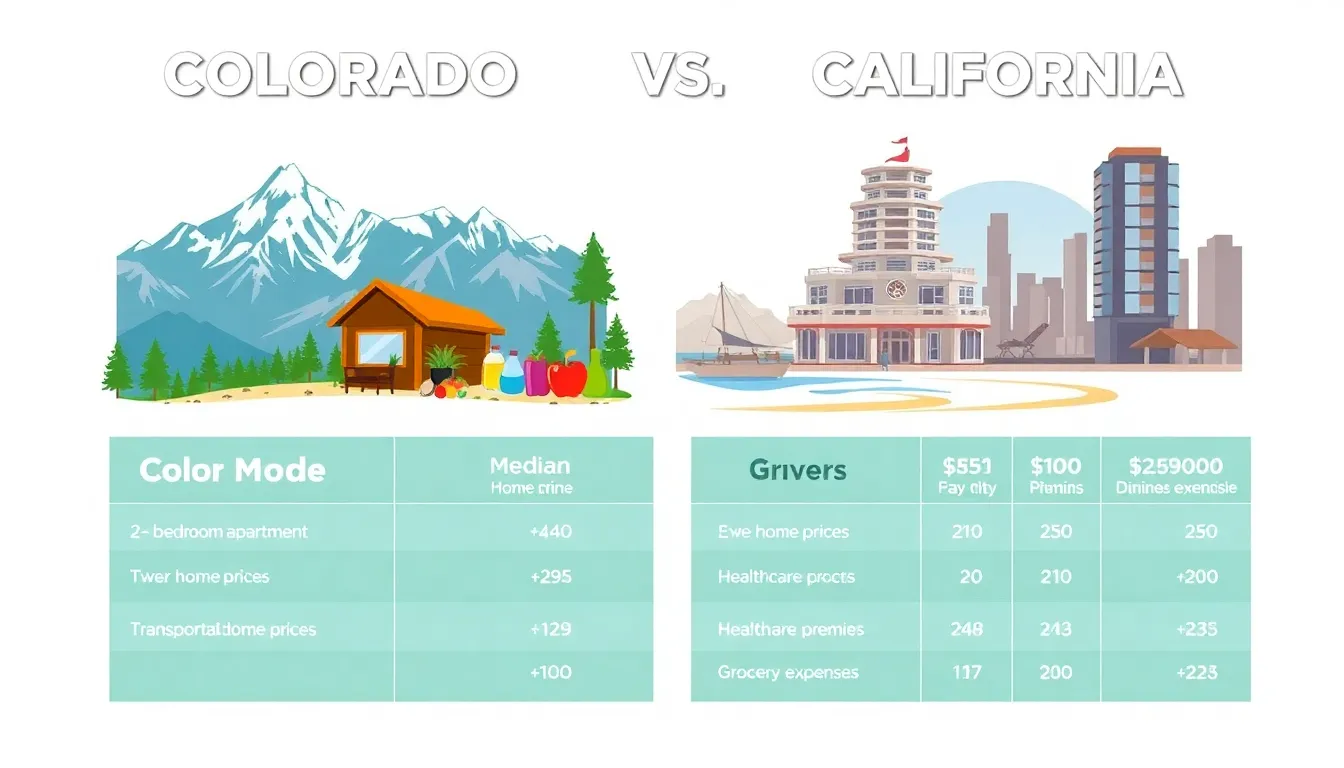

Overview Of Cost Of Living Differences

When comparing the cost of living between Colorado and California, a plethora of factors come into play. Generally, California tends to have a higher overall cost of living due to its extensive population, thriving economy, and desirability as a prime location. Cities like San Francisco and Los Angeles top the charts for housing expenses, while Colorado, particularly cities like Denver and Boulder, offers a somewhat more accessible lifestyle. But, several factors can determine the nuances in cost.

For instance, it’s imperative to consider not only housing but also transportation, healthcare, and recreation, areas where costs can fluctuate drastically. Also, both states are breathtaking in their own ways, presenting myriad opportunities for residents. Eventually, decisions on where to settle often boil down to personal priorities. Do you crave the mountains or the beaches? The bustling city or the serene suburbs? Let’s dig deeper into the specifics.

Housing Costs

Housing takes the cake when it comes to living expenses. California’s housing market can induce sticker shock for anyone moving there. The median home price in Los Angeles is astronomical, often hovering around $900,000, depending on the community. Renters are not spared either, with average monthly rents for a two-bedroom apartment hitting about $2,500. In contrast, Colorado, while increasingly popular, boasts more moderate prices. Cities like Denver have a median home price of around $600,000, making it a relatively appealing option for first-time homebuyers.

Rent in Denver for a similar two-bedroom apartment averages about $1,900, still high but significantly less daunting than many Californian metro areas. Also, areas outside major cities in Colorado can offer even more affordability, giving families and individuals a chance to own property or find reasonably priced rentals.

Utilities And Services

Utilities can often be the underdog of the budgeting equation. Colorado and California present varied costs in this arena. California’s high energy demands due to its warm climate can lead to increased electricity bills, with averages around $130 per month. Meanwhile, in Colorado, utility costs are slightly lower, averaging about $110 monthly.

Water costs align more closely, but Colorado might edge out California as rainfall contributes to lower costs in regions like Denver. Internet service providers are similar across both states, often running around $60 to $70 per month, depending on speed and service availability. A budget-savvy individual might save a few dollars in Colorado, but those savings can quickly evaporate based on lifestyle choices.

Transportation Expenses

Transportation is another critical concern for those analyzing cost. California’s love affair with cars leads to congested highways and pricey gas: currently, the average gas price can reach over $4 per gallon in major cities. Public transportation can ease some of the burden, but systems such as Los Angeles Metro and San Francisco’s BART can only do so much. Monthly transit passes often range from $80 to $120.

Conversely, Colorado is more accommodating in this aspect. While Denver has a burgeoning public transportation system, gas prices average slightly lower than California’s, making commuting less of a financial strain. Also, if you’re a skier, you’ll appreciate that some lift passes also include discounts on local transit, a sweet bonus for Colorado aficionados.

Healthcare Costs

Healthcare costs can profoundly impact one’s budget. While both states provide a wide array of options, California’s healthcare can be pricier overall. According to reports, the average monthly health insurance premium in California can run up to $450 per month. In comparison, Colorado’s health insurance premiums typically hover around $400.

Of course, these figures can vary based on weighty factors like provider choice, location, and healthcare coverage plans. Both states have excellent facilities and healthcare professionals, but cost can be a determining factor when choosing where to receive medical services. The wise individual will weigh the pros and cons of healthcare options meticulously.

Food And Grocery Prices

Here’s a fun fact: everyone’s got to eat. But how much one spends on food can greatly vary between Colorado and California. Grocery shopping in California is generally more expensive, with families spending around $500 a month for basic necessities, while in Colorado, the average falls closer to $450. This is primarily related to California’s higher transportation and labor costs.

Dining out can yield similar results. A casual dinner for two might cost about $70 in California, but in Colorado, you might manage to get away with around $50 for a comparable meal. While the culinary scene in both states offers an array of options, cost considerations can make a significant difference in day-to-day living.

Lifestyle And Recreational Spending

Lifestyle choices play a significant role in one’s financial commitments. Colorado, with its vast natural beauty, encourages outdoor activities at lower costs, think hiking trails and national parks. Meanwhile, while California offers stunning beaches and vibrant nightlife, the costs can pile up quickly. A visit to a popular theme park can set a family back significantly, while events and festivals often require hefty ticket fees.

That said, Colorado is not without its costs either. Ski passes can be a budget breaker if not planned well. Finding a balance between activities and lifestyle can require some strategic financial planning in either state, but outdoor enthusiasts might find Colorado more wallet-friendly in that department.